One of the main goals of investors is to keep their money from inflation. If you look at the stock market, everything is clear there, by investing in a company you get a percentage of growth, which most often overtakes the inflation rate. But if we talk about cryptocurrency, can it act as a full-fledged hedge against inflation.

Today we will analyze this issue, discuss the pros and cons.

To begin with, I propose to find out what inflation is, its main causes and much more.

What is inflation

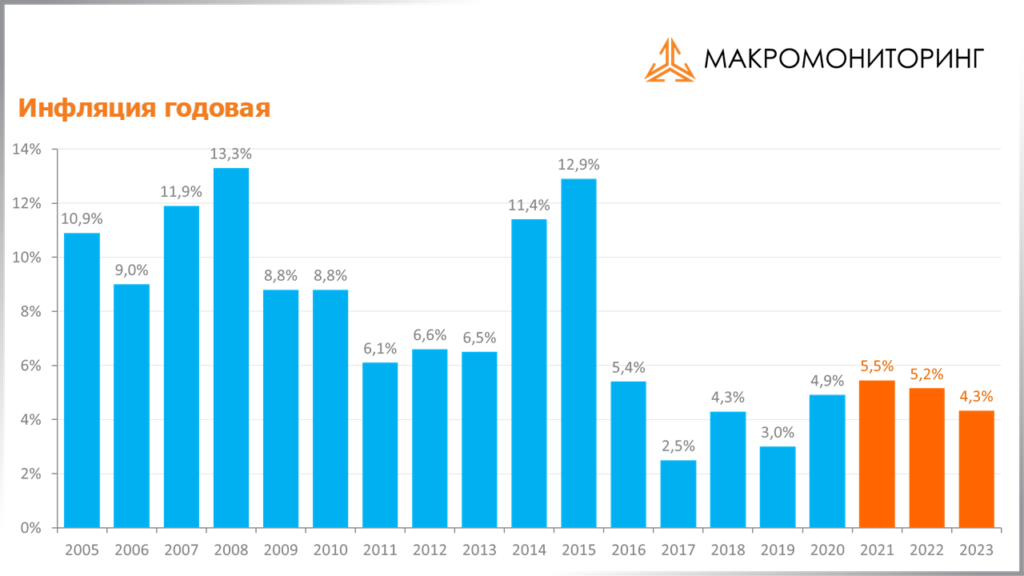

Inflation is an increase in the general level of prices for goods, various services, and everything that money can buy. With inflation, the price of the same product increases, this happens over time.

For example, in 2018 a bottle of milk cost 50 rubles, and already in 2022 it costs 60 rubles – inflation for 4 years was 20%.

Inflation should be distinguished from a price hike, as it is a long, steady process.

Inflation does not mean an increase in all prices in the economy, because prices for individual goods, works and services can rise, fall or remain unchanged.

The main difference between inflation is that during inflation, the general level of prices increases, not a specific product.

Causes of inflation

Let’s look at the main causes of inflation, what leads to it.

1. Excessive expansion of the money supply through mass lending. At the same time, funds for lending are not taken from savings, but are issued from the issue of unsecured currency. This is most noticeable during periods of economic crisis or military operations.

2. An increase in government spending, to finance which the state resorts to money emission, increasing the money supply (turning on the “printing press”) in excess of the needs of commodity circulation.

3. Reduction in the real volume of national production, which, with a more or less stable level of money supply, leads to an increase in prices, since a smaller volume of goods, works and services corresponds to the same amount of money, that is, per unit of goods produced, work performed, services rendered more money.

These are just a few of the causes of inflation, in fact there are many more.

But now let’s look at why cryptocurrency can be a good way to save money from inflation.

Cryptocurrency exit?

Everyone knows that cryptocurrencies are quite a technologically advanced field. And if you still compare cryptocurrency and fiat currencies, you can say for sure that in some respects the cryptocurrency wins. Let’s take bitcoin as an example, the maximum number of coins is 21 million coins and there is no possibility of additional issuance. Fiat, in turn, has an unlimited emission, so it loses to bitcoin.

Other cryptocurrencies, such as Ethereum, have a different mechanism for protecting against inflation – burning. But this is not a new idea. In traditional economics, there is such a thing as share buyback. While buybacks and coin burns are not exactly the same thing, the concepts are very similar.

Recently, cryptocurrency has become almost the first topic of discussion in the world of finance. Many have high hopes for cryptocurrency, investments in this area are growing exponentially

But a cryptocurrency has many characteristics that cannot be combined with an asset in the long term. But this is the advantage of cryptocurrencies. Volatility does not always bring harm and risks, but thanks to it you can make good money. Due to the fact that there is a lot of volatility in the cryptocurrency, the price movement is voluminous. Every minute the price changes, so the crypto market is a favorable environment for traders.

Conclusion

Therefore, in the long run, cryptocurrency is a good asset for overtaking inflation. Of course, there are huge risks of losing everything, but if you understand the essence of how the cryptocurrency works, how it works, etc., these risks can be mitigated.

You should not keep money under your pillow, investments are the key to a secure future. In this situation, everything depends on you.

Read more articles about cryptocurrencies and mining at CRYPTO-WALLETS.ORG.

The Telegram channel about cryptocurrency and mining Bitcoin, Ethereum, Monero and other altcoins: