Entering the world of cryptocurrency the question immediately arises, what is better, trading on the spot market or speculation on futures? Let’s break down what suits every beginner, where you can earn more, and find out the pros and cons of both sides.

Spot trading

To begin with, I propose to analyze spot trading, because it is the most common and popular among traders. The basic essence of this type of trading is quite simple.

Spot trading involves the direct buying and selling of financial instruments and assets such as cryptocurrencies, forex, stocks and bonds, in our case cryptocurrency. The delivery of the asset is usually immediate. Spot trading takes place in spot markets, which are either exchange traded or over-the-counter (trading directly between traders). Spot markets use only the assets you own – no leverage or margin.

Spot trading is an easy way to invest and trade. When investing in cryptocurrency, it is usually with a spot transaction on the spot market, such as buying BNB at the market price and holding it.

Spot traders aim to make a profit in the market by buying assets with the expectation that their price will rise. When the price of the asset rises, they can sell the asset at a profit.

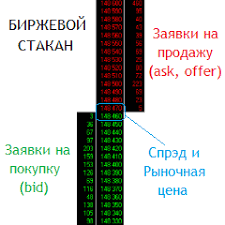

Order – an instruction to a broker to buy or sell a certain number of financial instruments. The order is sometimes called a bid or an order. On the exchange, as a rule, four main types of orders are used – market order, limit order, stop-limit order and stop-market order: stop-loss and take-profit.

The order allows you to see more clearly the status of your trade at the moment. You can also track all trades that take place in the market using the market depth chart.

The market glass, aka order book, aka order queue is a summary table, which provides information on limit bids to buy and sell for a particular asset in real time. The market depth and the order book are also sometimes called market depth.

Orders and the stock market is used in both spot and futures trading.

Futures trading

Cryptocurrency futures are contracts that reflect the value of the underlying cryptocurrency. When you buy a futures contract, you are not buying the underlying asset itself. You become the owner of the contract by assuming an obligation to buy or sell the underlying asset in the future.

Futures trading is somewhat similar to spot trading. But it’s worth noting right away that futures trading is much riskier than spot trading. 98% of beginners in futures trading lose their deposit and leave cryptocurrency altogether disappointed. Of course, you can make good money on futures, but you can also lose.

But still, let’s clarify the basic concepts in trading the futures market.

Leverage

Using leverage in futures trading increases capital efficiency. With futures contracts, you can open a position for 1 BTC using only a fraction of the value of the asset. Spot trading, on the other hand, does not use leverage. To buy 1 BTC on the spot market, for example, you will need thousands of dollars. Imagine you only have 10,000 USDT. In that case, you will only be able to buy 10,000 USDT worth of bitcoin.

Professional traders do not recommend trading with a leverage higher than 5, otherwise it is easy to lose a position or go into liquidation.

Flexibility to place long or short positions

If you hold assets after buying them on the spot market, you can eventually earn capital gains from the rising value of the cryptocurrency. Futures, on the other hand, allow you to capitalize on short-term price changes. Even if the price of bitcoin drops, you can make money on it by opening a down trade. Futures contracts can also be a hedge against unexpected changes in the market and strong volatility, making them an ideal product for miners and long-term investors.

Liquidity

Cryptocurrency futures markets are highly liquid. Their monthly trading volume is in the trillions of dollars. The bitcoin futures market, for example, has a turnover of $2 trillion. The high level of liquidity improves the price discovery process, allowing traders to transact quickly and efficiently in the market.

We’ve only covered a few concepts, it will take weeks to fully understand them, but the profits gained from successful trading are worth it.

Conclusion

If we talk about risks, of course spot trading is more risk-free and more suitable for beginners than futures trading. If you are a beginner, it is advisable to start with spot. Here you don’t have to monitor the market, buy and forget for a while, the price went up – sell.

But what is to your liking, only you know. On this, before you choose a direction in which to develop is precisely to understand whether you are ready for the condition, which provides for this type. Good luck to you beginnings!

Read more articles about cryptocurrencies and mining at CRYPTO-WALLETS.ORG.

The Telegram channel about cryptocurrency and mining Bitcoin, Ethereum, Monero and other altcoins: