Where is the best place to keep your stash, is it better to have a warm place under the pillow, or a bank, or maybe cryptocurrency. Today we’re going to figure out where it’s best to keep your savings and at the same time be able to multiply them. We’ll find out where to take money for savings, investments, vacations, and more.

Where to get funds for savings

On the one hand it may seem an ordinary question, where to get money for savings. But it’s not that simple, you need to be financially literate to allocate your finances wisely. Everyone has faced with the situation, whether to put the money to buy a new Mercedes or order groceries at home? Therefore, to avoid thinking about such things, it is important to plan your budget. What goes on food, an apartment and investments. Only by distributing your budget will you be able to approach your savings wisely.

It’s worth realizing right away that everyone’s case is different and it’s all completely individual. But whatever budget you have, whether it’s 5 thousand or 300. Well, in order to understand financial literacy and be in the trend, develop yourself, read books by Napoleon Hill, Robert Kiyosaki, George Clayson and improve your knowledge in the financial sphere!

Where to store the accumulation

Of course you can keep everything in currency under your pillow and wait for your money to depreciate. But it seems to me that not everyone likes this option, so let’s decide once and for all where to keep your money, not only in 2022, but also in the future.

Storage in currency

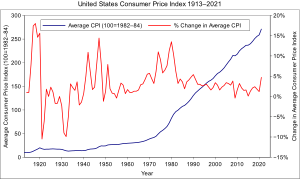

Fifty percent of our population simply keeps their money in dollars or euros. Of course the fact that the dollar will lose value is quite small, but inflation in the United States is no less than in Russia. Of course you can store your money in dollars, this is a good way to keep money for a short period of time, but not on a permanent basis.

Bank

Deposit or just keeping in a punk has its pros and cons. The conditions of the bank will not suit everyone. If you decide to put money in the bank at interest, it is worth to know: you can not on the first word to take money from the bank, in some banks there is a rule that if you want to get the money back before time, you will certainly give them, but without interest.

So if you are not ready to give your money for a certain period of time, the bank is definitely not for you.

Metals

From the lessons of history we can remember that 200 years ago all countries stored their savings and treasury in gold bullion. Of course now gold is not such a popular type of investment for the purpose of storing funds.

Gold is usually kept in special vaults at the bank or in a safe at home. You can’t convert gold into fiat in the short term, so it’s not the best way to do it in the short term. But if we talk about the long term, please, gold is a good option.

Cryptocurrency

We can say right away that cryptocurrency is more suitable for investment than for storage, but it is also a possibility. Everyone knows that cryptocurrency has a high volatility, so you can make good money, but you can also lose. Fortunately, cryptocurrency has ways to make money with minimal risks.

For storage and multiplication is well suited steaking, something like a bank deposit, but steaking is more profitable or the condition is better than in the bank.

Conclusion

We’ve broken down the main types of storage and accumulation of funds. What is right for you is, of course, up to you to decide! However, saving is a mandatory factor to consider when allocating your income.

Well, we wish you the best of luck in all your endeavors!

Read more articles about cryptocurrencies and mining at CRYPTO-WALLETS.ORG.

The Telegram channel about cryptocurrency and mining Bitcoin, Ethereum, Monero and other altcoins: